How To Guarantee Profitability In Your Business

January 30, 2024

Umm … guarantee? I know you’re probably thinking, “But Michelle, you can’t guarantee anything!” Well, friend, with this method, I think I can.

Did you know that the #1 reason small businesses fail is because they can’t turn a profit? And it’s no secret that everyone is taught to handle their finances (mostly) the same way. Receive income, pay off your bills, pay your employees, invest back into your business—oh, and then maybe have enough to pay yourself. And if there’s anything left? THEN you can call it profit.

So clearly, this is no bueno. It’s not sustainable, realistic, or in our best interest as business owners who deserve to get paid and make money from all of the work that we do day in and day out. But what’s a boss to do?!

I’ll tell you in two words:

PROFIT FIRST.

An Intro to Profit First

Profit First landed on the scene when serial business owneir and author Michael Michalowicz released his book teaching business owners how the f*** to manage their finances the simple way. And it was so incredibly simple that it was honestly a revelation. Who would think this could work?! He did. And now many other business owners know the same. Essentially, his assertion is this: Take your profit first, always.

Traditional accounting goes like this: sales – expenses = profit.

But what if there was another way?! (Spoiler alert: there is, and it’s amazing.)

Profit First accounting goes like THIS: sales – profit = expenses.

I know what you’re thinking — are we allowed to do that? Hell yes you are! You’re allowed to run your business however you see fit, so why not ensure profitability with the click of a mouse?

How Does Profit First Work?

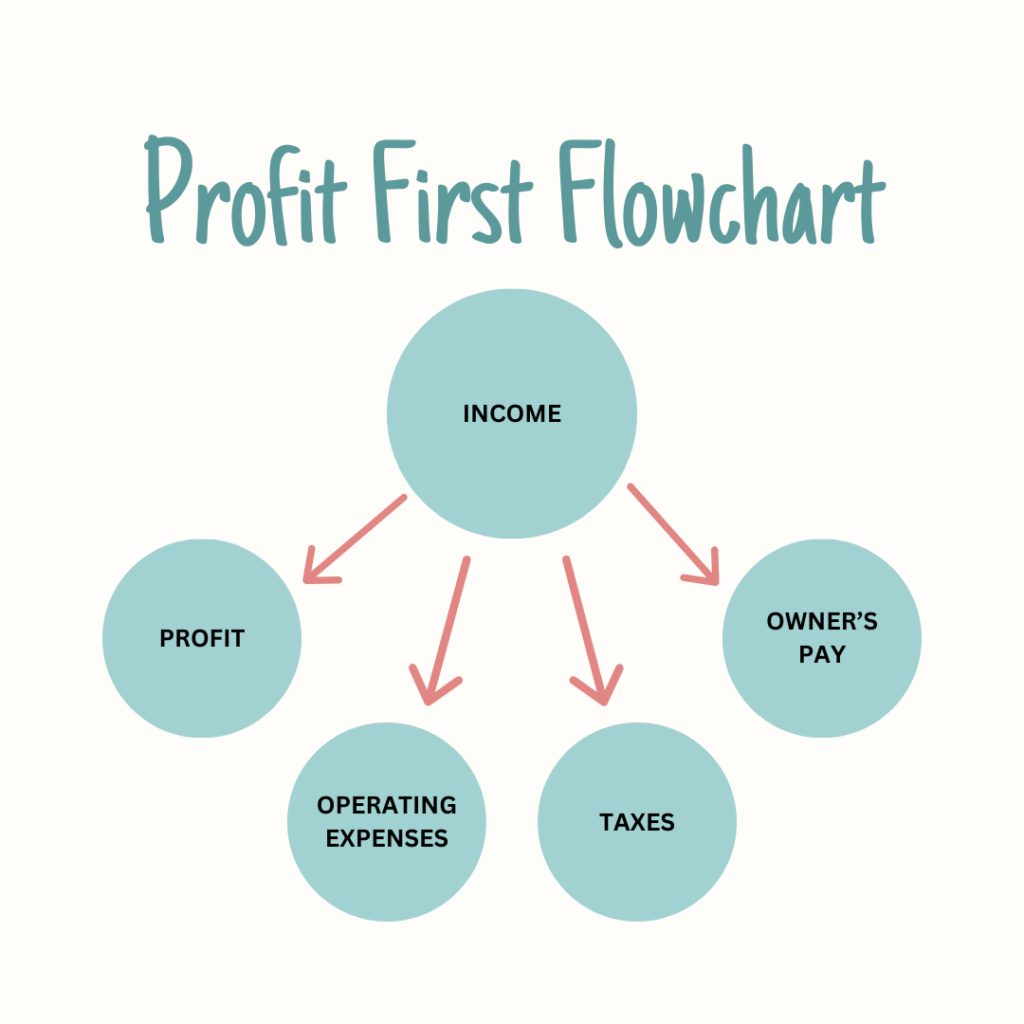

Profit First is a system of money management as a business owner that relies on the use of multiple bank accounts. You’ll allocate funds to each account on weekly or bi-weekly basis (whichever you prefer), and watch your profit grow.

The accounts you need include:

- Income

- Owner’s Pay

- Operating Expenses (OpEx)

- Taxes

- Profit

All of your invoices will be deposited into your “income” account and you’ll leave it there until you’re ready to do your weekly transfers. Then, you’ll divide up the money in your income account based on pre-determined percentages that best fit YOUR business and YOUR unique situation—remember, this isn’t one-size-fits-all, but Michael does provide guidelines and a way to determine your percentages in the book—and transfer the money out all at once.

Easy, right? Plus, it’s REALLY fun to see all of your different accounts grow on a regular basis.

What Are The Benefits of Profit First?

Managing your business finances with Profit First can be truly game-changing. Instead of working yourself to the bone and NEVER seeing a profit, you can prioritize your most important metric and figure out how to operate within your expense limits instead of overspending. Some other benefits include:

Makes Profit a Priority 💸

By using this system, you’ll get in the habit of ensuring that your profit is always a priority rather than an afterthought. It’s risky not to ensure a profit as a business owner (see: reasons business owners fail), and this way, you’ll HAVE to set that money aside before it hits your checking account, so it doesn’t go “missing.” (We’ve all done it, don’t worry 🤑).

Helps You Be Prepared for the Future

Sometimes things pop up that we aren’t expecting, and then we PANIC. Because how are we going to pay for this?! With your profit already set aside, you have emergency funds that you can dip into in the event that you need some quick cash—without relying on loans or credit and digging yourself further into debt.

Keeps Your Business Organized

Profit First will help you categorize your business costs with minimal effort because it’s already done for you—you spend out of your pre-determined accounts, making things easy peasy. You’ll also know exactly how much you have to spend in each category, so you’re never going overboard or committing to things you can’t manage.

What Are The Challenges of Profit First

Can Be Difficult to Implement 🤯

With Profit First, you need AT LEAST 5 business bank accounts to properly allocate your funds. Depending on the bank you use, it can be difficult to open that many accounts. Not to mention, some banks require fees for each account you hold, which can really add up. To cut down on the difficult, Profit First has partnered with a bank called Relay, which makes the process go MUCH more smoothly.

Might Be Complicated for High-Overhead Costs

Through this system, you won’t have access to every dollar that hits your account for business expenses. In fact, you might have as little as 25% of your income available for business expeneses. So if you’re already committed to a lot of overhead costs to make your business run, changing things up can be a challenge. However, as business owners, we’re scrappy—when you have to operate within the confines of a strict opex budget, you might just be able to figure it out and save dolla’ bills.

Might Not Work With High Amounts of Debt

If you have high amounts of debt related to your business, taking a profit might not be the best priority until that’s paid off. Instead, consider allocating the money that would go towards profit and put it towards your high-interest debt instead. Then you can come back to Profit First when you’re free and clear for a fresh start.

Can This Work for Brand-New Businesses?

HELL TO THE YES. Imagine how powerful it is as a new business owner to turn on profit on day one?! This is an especially easy-to-use system for service-based business owners that are also online providers because we often have low operating expenses (at least in the very beginning).

So if you’re new, I highly encourage you to try it out. You can’t go wrong!

If you want to read Profit First by Michael Michalowicz for yourself, buy it here.

If you’re interested in starting Profit First, find the official Profit First bank here.

Need help setting up and managing your business? Explore my services.

Are you ready to become a 6-figure CEO? Apply for my intensive.

Looking for free resources? Read through my other blog posts!

[…] Interested in the Profit First method? Read all about it in this blog post. […]